Medicare FAQs - Allboc Insurance Solutions - Allboc

Main menu:

FAQS > Medicare

info@allboc.com

Medicare FAQs

Medicare

What are my Medicare options?

What is a Medicare Supplement?

What is a Medicare Advantage Plan?

What is a Medicare Select Policy?

What is a Medicare Prescription Drug Coverage or commonly known as Part D or PDP?

How do you apply for Part D?

Long Term Care

Life Insurance

Individual and Family Health Insurance

Small Group Health Insurance

Allboc Insurance Solutions

Q: What is Medicare?

A: Medicare is health insurance from the federal government for Americans age 65 and over, and some people under age 65 with certain disabilities. It is not based on your income. It provides partial coverage for medical costs

Q: Is Medicare the same as Medicaid?

A: No. Medicaid is a jointly-run federal and state program for people wth lower incomes who meet the income and asset limits and are age 65 or over, blind, or have a disability.

Q: Can someone have both Medicare and Medicaid?

A: Yes. Some people with lower incomes qualify for both programs at the same time.

Q: What are the parts of Medicare?

A: Medicare has four Parts:

Part A: Hospital care: Covers care you receive in inpatient hospital settings.

Part B: Medical care : Covers your doctor visits, lab work, durable medical equipment, outpatient services, etc.

Part B: Medical care : Covers your doctor visits, lab work, durable medical equipment, outpatient services, etc.

Together, Parts A and B are sometimes called Original Medicare or Traditional Medicare.

Part C (Medicare Advantage or Medicare Health Plans): Optional, privately-run health plans that substitute for Original Medicare as long as you have the plan, and sometimes include Part D. These plans must provide the same benefits as Original Medicare, but may provide them in a different way (such as with different copays or coinsurance). If you leave a Medicare Advantage plan, you return to Original Medicare.

Part D: Optional, privately-run prescription drug plans. These may be stand-alone plans covering prescriptions only, or be included in a Medicare Advantage plan.

Q: Does Medicare include coverage for prescription drugs?

A: No. If you have Original Medicare and want drug coverage, you may want to think about joining an optional stand-alone Part D plan. This is a private insurance plan that covers prescription drugs only. Many Medicare Advantage plans already include Part D.

Q: What is a Medicare Advantage plan?

A: Medicare Advantage (MA) plans are optional private insurance plans that substitute for Original Medicare. You still have Medicare, but are not in Original Medicare. If you leave the MA plan, you return to Original Medicare. You must have Medicare Parts A and B to join an MA plan. MA plans must provide all Medicare-covered services to you. You use the MA plan’s card, not your Medicare card, when getting medical care. MA plans may have different rules and different out-of-pocket costs than Original Medicare but the plans are able to include prescription drug benefits and other benefits that go behond original Medicare.

Medicare Advantage is a special arrangement between the federal Centers for Medicare & Medicaid Services (CMS) and certain insurance companies. Under this arrangement the federal government pays the insurance company a set amount for each Medicare beneficiary. The insurance company agrees to provide all Medicare benefits. The insurance company may provide some additional benefits, and it may require payment of an additional premium. Beneficiaries under Medicare Advantage plans continue to pay the Part B Medicare premium for Medicare. A Medicare Advantage plan can terminate at the end of the contract year if either the plan or CMS decides to terminate their agreement. Medicare Advantage plans are regulated by the federal governement rather than by the state.

See also:

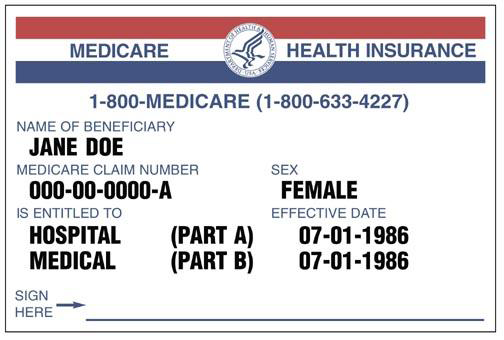

Q: What does a Medicare card look like?

Q: Is there a cost for Medicare?

A: Part A (hospital coverage) is typically premium free because most people have paid into that program during their working years. Some people may have to pay a premium if they (or their spouse) earned fewer than 40 credits (often worked fewer than 10 years) in jobs that paid into Medicare.

Part B (medical coverage) typically has a standard monthly premium. Some people with higher incomes may have higher premiums. As of 2015, the standard premium was $104.90 per month which is deducted directly from your Social Security beneifts if you are receiving Social Security.

Q: How do I join original Medicare?

A: If you started getting Social Security retirement or disability benefits before age 65: The Social Security Administration automatically enrolls you in Medicare Parts A and B. Medicare will let you know the effective date, and will also give you the option to defer Part B. You will need both Parts A & B in order to take a Medicare Supplement plan or Medicare Advantage plan.

If you have not yet applied for Social Security benefits: You will need to enroll in the parts of Medicare that fit your situation. This will not happen automatically. You may join Medicare Parts A and B during your Initial Enrollment Period - the seven month window surrounding the month of your 65th birthday. This includes the three months before your birthday month, the month of your birthday, and the three months after your birthday month.

Most people enroll through the Social Security Administration (SSA). Use one of the following options:

- Call the SSA at 1-800-772-1213

- Go online to www.socialsecurity.gov

- Visit your local SSA office

Q: What questions should I consider when choosing between a Medicare Supplement and Medicare Advantage program?

A:

- Does my doctor take this plan?

- If I qualify for the Low Income Subsidy or Extra Help from Social Security, how will this change my options and costs?

- If I qualify for a Medicare Savings Program through Medicaid, how will this change my options and costs?

- Will I be able to go to the provider or hospital of my choice?

- Does my out-of-pocket cost grow if I use the plan more?

- Is there an out-of-pocket limit per year? (This is a maximum amount I would have to pay out of pocket before the plan covers all care.)

- Will I have coverage if I travel outside my immediate area?

- Are there any protections (such as guaranteed renewability, etc.) for me in this plan? What are they?

- Are there any extra benefits provided to me in this plan? What are they?

- What is not covered?

- Will I need to consider buying a Part D plan?

Q: Can I enroll in Medicare outside of my seven month window?

A: Always check with Medicare but the usual special timeframes are:

- Special Enrollment Period 1: If you're covered under a group health plan based on current employment, you have a Special Enrollment Period to sign up for Part A and/or Part B any time as long as you or your spouse (or family member if you're disabled) is working, and you're covered by a group health plan through the employer or union based on that work.

- Special enrollment Period 2: You have an 8-month Special Enrollment Period to sign up for Part A and/or Part B that starts the month after the employment ends or the group health plan insurance based on current employment ends, whichever happens first.

- The General Enrollment Period occurs every year from Jan. 1 March 31. Your coverage will start July 1, and you may have to pay a late-enrollment penalty.

Q: Can I have both a Medicare Supplement (Medigap) plan and a Medicare Advantage plan?

A: Medigap plans do not fill gaps in Medicare Advantage plans. People with Medicare looking for other private insurance may choose between Medigap and Medicare Advantage plans, but cannot have both.

Q: What are Medicare Supplement (Medigap) plans?

A; Medicare Supplement plans are an optional way for people with Original Medicare to cover some or all out-of-pocket costs, such as deductibles and copays or coinsurance.

What do Medigap plans cover? In most states each Medigap plan has a Plan letter (A-N), which is different than the Parts of Medicare (A-D). These plans are standardized, meaning the federal government sets the benefits each Plan letter (A-N) must cover. The states of Massachusetts, Minnesota, and Wisconsin use different standardized plans. Plans with the same letter cover the same benefits. For example, a Plan F from one insurer covers the same benefits as a Plan F from a different insurer, despite any differences in cost. Based on the plan you buy, you will have either lower or no out-of-pocket costs when you receive Medicare-covered services at a participating provider or hospital. Medigap plans do not cover prescription drugs. If you choose one, you might also want to think about buying a Part D plan. If you buy a Medigap plan, the benefits under that plan will never change and the plan may not drop you as long as you pay your premiums. This is called Guaranteed Renewable.

What do Medigap plans cover? In most states each Medigap plan has a Plan letter (A-N), which is different than the Parts of Medicare (A-D). These plans are standardized, meaning the federal government sets the benefits each Plan letter (A-N) must cover. The states of Massachusetts, Minnesota, and Wisconsin use different standardized plans. Plans with the same letter cover the same benefits. For example, a Plan F from one insurer covers the same benefits as a Plan F from a different insurer, despite any differences in cost. Based on the plan you buy, you will have either lower or no out-of-pocket costs when you receive Medicare-covered services at a participating provider or hospital. Medigap plans do not cover prescription drugs. If you choose one, you might also want to think about buying a Part D plan. If you buy a Medigap plan, the benefits under that plan will never change and the plan may not drop you as long as you pay your premiums. This is called Guaranteed Renewable.

Individual Medicare Supplement policies are designed to help pay the deductibles and 20% not paid for under the original Medicare program. With a Medicare supplement policy you are able to see any physician who will bill Medicare first for services.

Individual Medicare supplement policies include a basic core of benefits. In addition to the basic benefits, Medicare supplement insurers offer specified optional benefits. Each of the options that an insurance company offers must be priced and sold separately from the basic policy.

Q: Who can buy a Medicare Supplement (Medigap) plan?

A: You can buy a Medicare Supplement if you have both Medicare Parts A and B. You also must be able to pass or be exempt from medical underwriting. You can buy a Medigap plan without going through underwriting during your first six months with Medicare Part B. This is sometimes called the Medigap Open Enrollment period or Guaranteed Issue. There is no yearly Medigap Open Enrollment period to change plans. If you miss your Medigap Open Enrollment, Medigap companies do not have to sell to you. They can require that you pass the medical underwritng criteria and if not, deny you based on your health.

Beneficiaries with disabilities. Disabled beneficiaries under the age of 65 have equal access to all Medicare supplement policies sold in many states.

Upon enrolling in Medicare Part B, a disabled beneficiary has a six-month enrollment period to buy supplemental coverage. That period begins the day Part B coverage becomes effective. Many states allow plans to set higher premiums for those under age 65 even though you may be eligible to Medicaare due to disability. Disabled Medicare beneficiaries typically cannot be turned down for a Medicare supplemental plan being sold during the initial six-month open-enrollment period but some states do not require that insurance companies offer their Medicare supplement plans to those under age 65. Coverage at the start of your Medicare is guarantee issue, but the same pre-existing condition limitation as applies to age 65 beneficiaries may apply. A second open-enrollment period will apply when the disabled Medicare beneficiary turns 65.

Upon enrolling in Medicare Part B, a disabled beneficiary has a six-month enrollment period to buy supplemental coverage. That period begins the day Part B coverage becomes effective. Many states allow plans to set higher premiums for those under age 65 even though you may be eligible to Medicaare due to disability. Disabled Medicare beneficiaries typically cannot be turned down for a Medicare supplemental plan being sold during the initial six-month open-enrollment period but some states do not require that insurance companies offer their Medicare supplement plans to those under age 65. Coverage at the start of your Medicare is guarantee issue, but the same pre-existing condition limitation as applies to age 65 beneficiaries may apply. A second open-enrollment period will apply when the disabled Medicare beneficiary turns 65.

See also: When can I buy a Medicare Supplement plan?

When can I buy a Medigap plan?

A: Unlike other private insurance that works with Medicare, there is no yearly open enrollment to join a Medigap plan. You can apply to the insurance company directly to buy a Medigap plan at any time, but the insurer could also require you to pass a health screening before it will sell to you. There are certain times when you may be exempt from taking the health screening, including if:

- You are in your first six months with Medicare Part B.

- You have Original Medicare and are enrolled under an employer group health plan (as an employee, retiree or dependent) and you stop receiving coverage under the group plan.

- You are in a Medicare Advantage Plan, Medicare Select plan, or PACE plan and your plan is leaving Medicare, stops giving care in your a rea, you move out of the plans service area, or the plan violates an important rule outlined in your policy.

- Your Medicare supplement insurance company goes bankrupt and you lose coverage, or your Medicare supplement coverage otherwise ends through no fault of your own.

- You left a Medigap plan for Medicare Advantage, and want to return to your Medigap plan within 12 months, or you joined a Medicare Advantage plan when you first joined Medicare, and want to leave that for a Medigap plan within 12 months. In these cases, you may still be limited to Medigap plans available to people in your age group.

- You lose eligibility for Medicaid.

Q: What do Medicare Supplement (Medigap) policies cost?

A: The cost of a Medicare Supplement varies depending on several factors including your age, where you live, in some cases your gender, and the type of plan you select. If purchased outside of your guaranteed issue or open enrollment timeframes you may also pay more if you use tobacco or have certain health conditions. Call us today at (920) 858-8752 for a free quote.

If you get a Medigap plan, in addition to the premium for that plan, you still pay your monthly premiums for Medicare Part B (and Part A, if any).

Also, some Medigap plans have a waiting period to cover pre-existing conditions. This waiting period may last up to six months, even if you are in your Medigap Open Enrollment. You might be able to have the plan waive this waiting period if you are replacing other creditable coverage within 63 days.

Also, some Medigap plans have a waiting period to cover pre-existing conditions. This waiting period may last up to six months, even if you are in your Medigap Open Enrollment. You might be able to have the plan waive this waiting period if you are replacing other creditable coverage within 63 days.

Q: What are Medicare Part D (Prescription Drug) plans?

A: These plans are a voluntary way for people with Medicare to have prescription drug coverage. Most people must enroll to have Part D - it is usually not automatic. The plan may be a stand-alone plan, or be included as part of a Medicare Advantage plan.

What do Part D plans cover? Prescription drug costs only. Each plan has a formulary, or list of drugs it covers. It may have rules about how it covers specific drugs. For certain medications, the plan may have quantity limits, or requirements that you try other drugs first.

Who can buy Part D plans? Anyone with Medicare Part A, Part B, or both. You also must live in the plan's service area. You can only have one Part D plan at a time.

What do Part D plans cost? Costs vary widely. Part D plans have a monthly premium, and also can have deductibles and copayments or coinsurance. People with income above $85,000 (single) and $170,000 (couple) pay higher premiums.

Most plans include a coverage gap (donut hole) after your prescription costs meet a certain amount in the Initial Coverage Level. You may pay a higher coinsurance amount during the coverage gap. You still pay your premiums for Medicare Part B (and Part A, if any).

Your costs for Part D also can vary widely based on the:

If you have a late-enrollment penalty for Part D, the plan will add this to your premium.

Who can buy Part D plans? Anyone with Medicare Part A, Part B, or both. You also must live in the plan's service area. You can only have one Part D plan at a time.

What do Part D plans cost? Costs vary widely. Part D plans have a monthly premium, and also can have deductibles and copayments or coinsurance. People with income above $85,000 (single) and $170,000 (couple) pay higher premiums.

Most plans include a coverage gap (donut hole) after your prescription costs meet a certain amount in the Initial Coverage Level. You may pay a higher coinsurance amount during the coverage gap. You still pay your premiums for Medicare Part B (and Part A, if any).

Your costs for Part D also can vary widely based on the:

- Plan you select

- Medications you take

- Pharmacies you use to get prescriptions filled

If you have a late-enrollment penalty for Part D, the plan will add this to your premium.

Medicare contracts with private companies to offer this drug coverage. Premiums, deductibles, co-payments, co-insurance and specific drugs covered vary depending on which drug plan you choose.

Q: Once I choose a Part D plan, do I have to keep it forever?

A: No. You can change plans every fall. Your new plan will start Jan. 1. Some people also get more chances to change, or special enrollment periods for other events (such as moving, losing group insurance, or qualifying for help with costs). To switch plans, just enroll in the new plan (Medicare will notify your old plan).

Q: What is the Late Enrollment Penalty (LEP)?

A: While Part D is optional, some people who join Part D later than when they first qualify may have to pay a late-enrollment penalty.

Q: What questions should I ask when selecting a Part D Plan?

A:

- Are all my medications on the formulary?

- Do any of my medications have limitations, such as requiring use of tiers, prior approval, step therapy, or quantity limits?

- What pharmacies can use with this plan?

- Will I have different costs depending on which ones I go to?

- What is the monthly premium for the plan?

- Do I have to meet a deductible before the plan starts to provide coverage? If yes, how much is it? How long does it look like it will take me to reach that amount?

- What will I have to pay each month for my medications? Will there be any variation month to month, such as when I reach the coverage gap?

- If I get medications by mail order, will this save me money? Yes No Can I get my medications in 90-day supplies? Will this save me money?

- What is the total yearly cost to me for the plan (premiums, deductible, co-payments, etc)?

Q: When may I join a Part D plan?

A: If you are turning age 65, you can join Part D in your Initial Enrollment Period, the seven months surrounding your birthday month. If you already have Medicare, you can join Part D every fall from October 15 through December 7. The plan starts Jan. 1. If you have never had Part D drug coverage, or you have had drug coverage which was not as good as Part D, you may have to pay a late-enrollment penalty. You also may have special enrollment periods to join Part D at other times in the year, such as if you lose creditable coverage, move, or if you receive Extra Help such as the Medicare Savings Programs or Medicaid.

Under age 65 and starting Medicare for disability?

If yes, you can join Part D plans during the seven months around your Medicare effective month.

If yes, you can join Part D plans during the seven months around your Medicare effective month.

Q: How do I join a Part D plan?

A: Contact Allboc Insurance Solutions at (920) 858-8752.

Everyone with Medicare, regardless of income, health status, or prescription drugs used, can get prescription drug coverage.

You may sign up for a drug plan during your initial enrollment period when you first become eligible for Medicare (three months before the month you turn age 65, the month you turn 65, and until the end of the third month after you turn age 65). If you get Medicare due to a disability, you will have the same 7 month window of time but it will be based on the month that your Medicare begins. If you don't sign up for a drug plan when you are first eligible, you may pay a penalty when you later start a drug plan.

Q: Are there programs to help me pay for Medicare and my Part D Plan?

A: Yes. These programs are typically based on your income level. Contact Social Security and/or your state's Medicaid to see if your qualify.

Q: What are Medicare Advantage (Medicare Part C) plans?

A: These plans are optional private insurance coverage for people with Medicare. These plans substitute for Original Medicare as long as you are in the Medicare Advantage (MA) plan. Do not throw away your Original Medicare card. You are still enrolled in Medicare! If you ever leave the MA plan you will return to Original Medicare. Store your Medicare card in a safe place!

Q: What do Medicare Advantage plans cover?

A: The private insurance company that sells you the plan must provide you all Medicare-covered services, and may offer other coverage as well, such as dental, vision, or Part D prescription drug coverage. The plan may charge you different deductibles and copayments or coinsurance than under Original Medicare. It also may have specific rules about which providers you may see for your care.

Coverage also depends on the plans structure. Most Medicare Advantage plans have one of the following structures. Be sure you understand how the plan works, and any limits on providers you can see, before you join!

Coverage also depends on the plans structure. Most Medicare Advantage plans have one of the following structures. Be sure you understand how the plan works, and any limits on providers you can see, before you join!

- Health Maintenance Organizations (HMOs): The plan covers care only with providers within the plan's network. Under most plans you must have a primary care doctor in the network, and some plans require that you get referrals from that doctor to see specialists.

- Preferred Provider Organization (PPO): Your costs are lower if you go to providers within the plan's network, but the plan still covers some costs if you see providers outside the plan's network.

- Private Fee-For-Service (PFFS): CMS does not require providers, including physicians, home health agencies, and equipment suppliers to accept the terms of a PFFS plan. It is critical to know that any provider may choose to accept or not accept the terms of the PFFS plan each time a patient visits the provider. Enrollees cannot trust that their preferred doctors and hospitals will remain PFFS providers even if they received covered services through these providers previously.

Q: What will a Medicare Advantage plan cost me?

A: Costs vary widely. These plans generally have a monthly premium, and may also have deductibles and copays or coinsurance. In many cases, plans with lower monthly premiums have higher deductibles, copays and coinsurance.

If the plan includes Part D coverage you may have separate deductibles, copays, coinsurance, and a coverage gap (or donut hole) for your drug coverage. Medicare is phasing out the donut hole by 2020. You still pay your premiums for Medicare Part B (and Part A, if any).

If you have a late-enrollment penalty for Part D, this will be added to your Medicare Advantage plan premium, if any.

If the plan includes Part D coverage you may have separate deductibles, copays, coinsurance, and a coverage gap (or donut hole) for your drug coverage. Medicare is phasing out the donut hole by 2020. You still pay your premiums for Medicare Part B (and Part A, if any).

If you have a late-enrollment penalty for Part D, this will be added to your Medicare Advantage plan premium, if any.

Q: Can I buy a Medicare Advantage plan?

A: Yes, if you have both Medicare Parts A and B, and do not have End Stage Renal Disease (ESRD). You also need to live in the plan's service area. There is no health screening.

Q: When can I buy a Medicare Advantage plan?

A: You can join Medicare Advantage during your initial enrollment period, which is the same seven months surrounding your birthday month. Also, you can join, switch or leave plans every fall between October 15 and December 7, with the new plan starting Jan. 1.

Q: Can I join a plan if I am under age 65 and starting Medicare for disability?

A: If yes, you may join a Medicare Advantage plan during the seven months surrounding your Medicare effective month. Medicare Advantage plans may decline to cover you if you have End Stage Renal Disease (ESRD).

Q: How do I join a Medicare Advantage plan?

A: Sign up first for Original Medicare with Social Security. Then join the Medicare Advantage plan:

- By calling Allboc Insurance Solutions at (920) 858-8752

- By phone with Medicare at 1-800-MEDICARE (1-800-633-4227)

- By phone with the plan directly

- Online at www.medicare.gov

Q: If I choose a Medicare Advantage plan, do I have to keep it forever?

A: No. You can change plans every fall from October 15 through December 7. Your new plan starts Jan. 1. If you do nothing during this annual enrollment period, and your plan is offered for the following year, you will remain on the same plan subject to any changes noted for the new year. You also can leave the plan for Original Medicare during this enrollment period and every year from Jan. 1 - Feb. 14. Some people get additional chances to change, or special enrollment periods, for other events (such as moving, qualifying for help with costs, etc.). To switch plans, just enroll in the new plan (do not disenroll from the old plan first). Medicare will disenroll you from the old plan when your new plan starts.

If you choose a Medicare Advantage plan when you first get Medicare and then decide within 12 months it is not right for you, you may have rights to rturn to Original Medicare and buy a Medigap plan instead. Also, if you left a Medigap plan for a Medicare Advantage plan, you might be able to return to that Medigap plan within 12 months. Keep in mind your premium could be different than when you left.

Q: Why would I join a Medicare Advantage plan instead of staying in Original Medicare?

A: This is a very personal decision and people may make it for a variety of reasons. Some reasons we have heard from clients include:

For greater provider access in some areas of the state. Some counties have few providers willing to take new Medicare patients, or patients with both Medicare and Medicaid. In some cases, people find they have better provider access with a Medicare Advantage plan that has a network of providers.

No health screening. Some people, especially those with disabilities who are under age 65, may not qualify for a Medigap/Medicare Supplement plan due to their health. Unless people have End Stage Renal Disease, they can join a Medicare Advantage plan regardless of health.

Q: Why would I stay in Original Medicare with a Medigap instead of joining Medicare Advantage?

For greater provider access in some areas of the state. Some counties have few providers willing to take new Medicare patients, or patients with both Medicare and Medicaid. In some cases, people find they have better provider access with a Medicare Advantage plan that has a network of providers.

No health screening. Some people, especially those with disabilities who are under age 65, may not qualify for a Medigap/Medicare Supplement plan due to their health. Unless people have End Stage Renal Disease, they can join a Medicare Advantage plan regardless of health.

Q: Why would I stay in Original Medicare with a Medigap instead of joining Medicare Advantage?

A: This is a very personal decision. Some reasons weve heard from clients include:

Peace of mind paying a flat rate for a premium to have lower or no out-of-pocket costs and balances when you get care.

Ability to travel in the U.S. without worrying if you are in a plan's service area.

Freedom to choose providers with no referrals required.

Peace of mind paying a flat rate for a premium to have lower or no out-of-pocket costs and balances when you get care.

Ability to travel in the U.S. without worrying if you are in a plan's service area.

Freedom to choose providers with no referrals required.

Q: Are you leaving a Medigap plan?

A: If you change from a Medigap to a Medicare Advantage plan or other replacement plan, its up to you to cancel your Medigap/Medicare Supplement coverage.

If you paid a yearly premium for your Medigap plan, the law does not require the plan to refund you any portion of that premium. Do not cancel your old plan until you verify you are active in your new coverage.

A: If you change from a Medigap to a Medicare Advantage plan or other replacement plan, its up to you to cancel your Medigap/Medicare Supplement coverage.

If you paid a yearly premium for your Medigap plan, the law does not require the plan to refund you any portion of that premium. Do not cancel your old plan until you verify you are active in your new coverage.

Q: What is a Medicare Select Policy?

A: Medicare select policies supplement the benefits available under the Medicare program and are offered by insurance companies and health maintenance organizations (HMOs). Medicare select policies are similar to standard Medicare supplement insurance but the covered services must be obtained through plan providers selected by the insurance company or HMO. Each insurance company that offers a Medicare select policy contracts with its own network of plan providers to provide services. Medicare Select insurers must pay supplemental benefits for emergency health care furnished by providers outside the plan provider network. Medicare select policies typically deny payment or pay less than the full benefit if you go outside the network for non-emergency services. However, Medicare still pays its share of approved charges if the services you receive outside the network are services covered by Medicare.